Best Debit Cards with High Cashback & Rewards

Discover a detailed review of 10 top debit cards offering high cashback and rewards. Compare features, benefits, and savings to choose the best one for you.

Now, a debit card is more than just a simple payment card helping customers with online transactions. It has evolved into a powerful financial tool offering profitable cashback and rewards. These benefits provide a helping hand to users who want to maximize their spending with monetary returns and exclusive perks on everyday purchases.

The best debit card for cashback equips customers with lucrative savings with every transaction. Whether for groceries, dining, fuel, or online shopping. This review covers the 10 best debit cards, selected based on cashback offers, exclusive perks, and value-added benefits.

Top Debit Cards Offering High Cashback & Rewards

The Platinum Debit Card offers attractive cashback on online transactions, plus complimentary airport lounge access. It comes with high daily transaction limits, making it top on the list for frequent shoppers and travelers.

#2 Kotak Privy League Signature Debit Card

Designed for premium banking customers, the Privy League Signature Debit Card provides higher withdrawal limits, exclusive lifestyle benefits, and complimentary lounge access. It also includes insurance coverage for added financial security.

#3 RuPay SBI IOCL Platinum Debit Card

The Rupay SBI Platinum Debit Card is a widely accepted best debit card for cashback that provides higher withdrawal limits, exclusive lifestyle benefits, and complimentary lounge access. Additionally, it includes insurance coverage for added financial security.

#4 ICICI Expressions Debit Card

The Expressions Debit Card holders can leverage a personalized design while enjoying high transaction limits, reward points, and online shopping benefits. The card also includes fraud protection and contactless payment features.

It is an affordable and accessible card with domestic acceptance, offering cashback on select transactions and insurance benefits. Kotak PVR Debit Card is well-suited for regular banking needs in India.

#6 Kotak Silk Platinum Debit Card

The Silk Platinum Credit Card by Kotak Mahindra Bank provides higher daily withdrawal and spending limits, lounge access, and exclusive merchant discounts. Ideal for users looking for premium banking benefits.

The Axis Priority Debit Card is the best debit card for cashback. It offers priority banking privileges, high transaction limits, and complimentary lounge access. The Axis Priority Debit Card comes with reward points and added security features.

#8 HDFC Rupay Platinum Debit Card

RuPay Platinum Debit Card provides cashback on utility bills and shopping, insurance coverage, and access to exclusive RuPay offers. It’s a good option for budget-conscious spenders.

#9 HDFC Easyshop Woman's Advantage Debit Card

The Easyshop Woman's Advantage Debit Card offers up to 5% cashback on PayZapp & SmartBuy transactions, plus 1 cashback point per ₹200 spent on select categories. It includes high debit limits, insurance cover, zero liability, and contactless payments. It is the best debit card for cashback for women as it also provides no-cost EMI options on top brands.

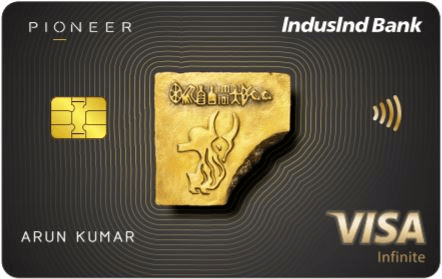

#10 Pioneer Inifinite Debit Card

The Kotak Easy Pay Debit Card offers extensive travel and lifestyle privileges, including higher spending limits. It is ideal for high-net-worth individuals seeking extra perks. It provides currency mark-up of 3.5% on foreign currency.

Best Debit Card for Cashback: Key Factors to Consider

As discussed above, the best cashback prepaid card requires careful consideration of various factors, including transaction benefits, spending categories, and reward structures. With the right choice, cardholders can maximize their savings on everyday expenses.

1. Cashback Percentage and Categories

The primary factor when selecting the best debit card for cashback is the percentage of cashback offered. Some cards provide a flat cashback rate on all transactions, while others offer higher returns on specific categories such as:

-

Online shopping and e-commerce purchases

-

Grocery and supermarket expenses

-

Dining and restaurant payments

-

Fuel purchases and utility bill payments

A card with category-based rewards can help optimize savings based on spending habits. For those who frequently shop online, selecting a debit card that offers higher cashback on e-commerce transactions can be a financially beneficial choice.

2. Monthly and Annual Cashback Limits

Many banks impose restrictions on how much cashback can be earned in a given month or year. While a card may advertise a high cashback percentage, understanding the maximum cashback cap is crucial. Some premium debit cards allow unlimited cashback, while others have limits ranging from ₹500 to ₹5,000 per month.

For individuals who frequently make high-value transactions, opting for the best debit card for cashback with a higher low limit can be a better financial decision.

3. Partnered Merchants and Exclusive Deals

Several banks partner with specific merchants and online platforms to offer exclusive cashback deals. These partnerships can significantly enhance savings when using the best cashback prepaid card for transactions on:

-

Online marketplaces like Amazon, Flipkart, and Myntra

-

Food delivery apps such as Zomato and Swiggy

-

Travel booking platforms like MakeMyTrip and Yatra

4. Reward Redemption Process

The usability of cashback rewards is another crucial factor. Some debit cards offer instant cashback credited to the account, while others provide reward points that need to be redeemed manually. The best debit card for cashback will have a seamless redemption process, making it easier to utilize the savings without extra effort.

5. Fees and Additional Charges

While many banks offer cashback debit cards with no annual fee, some high-reward cards come with maintenance charges. It’s essential to consider:

-

Annual fees and renewal charges

-

Minimum balance requirements

-

Hidden transaction fees on online or offline purchases

A balance between benefits and costs should be maintained to ensure that the cashback earned outweighs any applicable charge.

6. Additional Benefits and Features

Apart from cashback, the best cashback prepaid card may also offer additional perks such as:

-

Airport lounge access

-

Complimentary insurance coverage

-

Discounts on entertainment, shopping, and dining

-

Enhanced security features like fraud protection and zero liability on unauthorized transactions

Summary

The best debit card for cashback includes transaction benefits, merchant partnerships, and personal purchasing habits. Cards that offer high cashback rates, minimal restrictions, and a simple redemption process provide the most value. Making an informed choice that optimizes financial savings requires evaluating annual fees, spending caps, and category-based rewards.

One can make sure they select a debit card that best suits their financial requirements and maximizes cashback rewards by weighing their selections and understanding essential factors.