Best Debit Cards in India in 2025

In today’s fast-paced digital world, debit cards have become an essential financial tool for millions of people across India. They offer a secure, cashless way to make payments—whether you’re shopping online, paying bills, withdrawing cash from ATMs, or making purchases at retail outlets. With the surge in digital transactions and UPI-based payments, debit cards continue to hold their ground as a trusted and convenient option.

India’s leading public and private sector banks offer a wide variety of debit cards, each tailored to different needs—ranging from basic use to premium services with exclusive benefits. These cards not only offer direct access to your savings or current account but also come packed with features such as cashback offers, reward points, shopping discounts, travel benefits, fuel surcharge waivers, and zero liability protection.

While many banks in India have earned consumer trust over the years, only a select few stand out by consistently delivering top-notch services and value-packed debit cards. From seamless transactions to customer support and innovative offers, these cards have made a mark by offering something beyond the basics.

What Makes a Debit Card the Best in India?

Choosing the right debit card depends on your lifestyle and spending habits. Here are a few factors that make certain cards rise above the rest:

• Cashback and Rewards: Get rewarded for everyday spending.

• Wide Acceptance: Domestic and international usability.

• Low or No Annual Fees: Value for money.

• ATM Withdrawal Limits: Higher limits offer better liquidity.

• Add-On Features: Travel insurance, dining offers, lounge access, and fuel waivers.

Why Debit Cards Are Still Relevant in 2025

Even with the growing popularity of credit cards and digital wallets, debit cards continue to offer several unique advantages:

• No Debt or Interest: Spend what you have—no surprises.

• Better Control on Spending: Perfect for budget-conscious users.

• Safe and Secure: Protected with PINs, OTPs, and chip-based technology.

• Ideal for Students & First-Time Bank Users: Simple and easy to use.

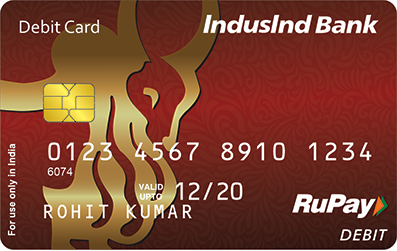

Rupay Debit Card

Get the Rupay Debit Card with exciting rewards, cashbacks, and offers. Enjoy shopping, travel, and more with flexible fees and convenient limits.

Details for

Rupay Debit Card

The Rupay Debit Card offers a transaction limit of ₹1,10,000 and ATM withdrawal limit of ₹1,10,000. Enjoy rewards, cashbacks, and access to exclusive offers. Perfect for shopping, travel, gifting, and dining with account-dependent fees.

₹

Annual Fees

Not available

₹

Transaction Limit

10000/-

EMI

International Online Transaction

Exclusive Benefits and Offers

- Account dependent Joining fees

- Account dependent Annual fees

- *An exchange rate is applied by the networks (VISA / MasterCard / RuPay) for processing the conversion from INR to the foreign currency.

- Can be used for shopping, gifting, travelling or eating out

Gold Debit Card

Gold Debit Card with rewards, cashback, and offers. Enjoy Rs 1,00,000 ATM limit, purchase protection, and flexible annual fees.

Details for

Gold Debit Card

The Gold Debit Card offers exclusive rewards, cashback, and benefits, including Rs 1,00,000 ATM withdrawal limit, Rs 50,000 purchase protection, and annual fee flexibility. Enjoy secure international online transactions and easy EMI options for added convenience.

₹

Annual Fees

Not available

₹

Transaction Limit

1,00,000/-

EMI

International Online Transaction

Exclusive Benefits and Offers

- Account Dependent Issuance/Annual Fee

- Lost Card Liability- 1,00,000

- Purchase Protection - 50,000

Business Debit Card

Explore Central Bank Of India Business Debit Card with exclusive rewards, insurance coverage, and lounge access. No annual fees, high transaction limits!

Details for

Business Debit Card

The Central Bank Of India Business Debit Card offers rewards, domestic & international lounge access, and comprehensive insurance coverage. It features a Rs. 1,00,000 ATM withdrawal limit, Rs. 3,00,000 transaction limit, and no annual fees.

₹

Withdrawal Limit

1,00,000/-

₹

Transaction Limit

3,00,000/-

EMI

International Online Transaction

Exclusive Benefits and Offers

- Domestic Lounge Access & International Lounge Access

- Insurance coverage - Accidental death & permanent total disability - 10 lac

- Air Accident Coverage- 20 lac

- Common Carrier Lost Baggage-20 lac

- Purchase Protection coverage- 2 lac